| https://www.next-finance.net/en | |

|

Strategy

|

ECB Policy Move Favors Riskier Assets

The European Central Bank’s (ECB) recently announced bond buying program should help stabilize financial markets both in the Eurozone and elsewhere. However, quantitative easing by the ECB may not be a panacea for what ails the Eurozone. More must be done to heighten the global competiveness of member economies.

Foremost is the implementation of labor market reforms that enhance the mobility and wage flexibility of Eurozone workers.

Early on such reforms should restrain the growth of European wages. And that will reduce the risk of a flare-up of Eurozone inflation despite the more stimulatory monetary policy and cheaper euro exchange rate.

Subpar Wage Growth Will Keep US Inflation at Bay

The likely combination of slower wage growth throughout the rest of the world and the US’s loss of competitiveness to a costlier dollar exchange rate will help to curb US wage growth. A recent consensus forecast calls for an acceleration by the year-to-year increase of the average hourly wage from December 2014’s 1.7% to 2.7% by December 2015, where the latter would still fall short of the 3% to 4% range that was common to the mature phase of previous economic recoveries.

However, the anecdotal evidence suggests that the average wage of year-end 2015 will grow at a pace that is closer to 2.0% than to 3.0%. Indications are that financially strong companies having healthy earnings growth are adhering to 2% wage hikes for 2015. Thus, businesses with average prospects are not likely to increase wages by more than 2% annually.

As inferred from December 2014’s 1.6% annual rate of core CPI inflation, 2015’s annual increase by average hourly earnings is likely to be in a range of 1.75% to 2%. Moreover, it’s difficult to imagine why businesses would offer wage hikes in excess of 2% annually, on average, given modest prospects for core profits amid a still slack labor market.

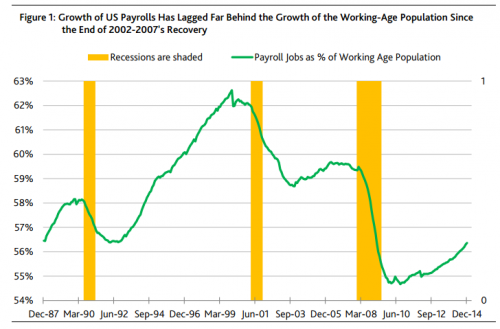

Despite how December 2014’s payrolls were up by 2.0 million jobs from their previous cycle peak of January 2008, such employment growth approximated just 25% of the accompanying 8.1 million person increase in the number of Americans aged 16- to 64-years. In turn, the ratio of payrolls to the Labor Department’s estimate of the working age population fell from January 2008’s 59.5% to December 2014’s 56.4%. (Figure 1.)

Regarding profitability, Bloomberg’s latest consensus predicts the operating income of the S&P 500’s member companies will rise by less than 2% annually, on average, during 2015’s first three quarters, which is much slower than yearlong 2014’s prospective gain of 6.5%. The containment of wage growth will limit the upside for the US short- and long-term interest rates. According to a recent interest-rate futures contract, the federal funds rate may be no greater than 0.5% by the end of 2015.

US Treasury Yields May Be Reined In by Ultra-Low Yields Abroad

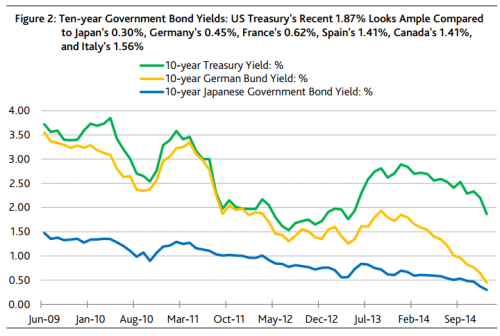

A limited upside for the federal funds rate, which may rise no greater than 2.5% during the next tightening cycle, and the exceptionally low government bond yields of other advanced economies ought to rein in US Treasury bond yields. In terms of 10-year sovereign government bond yields, the recent 1.87% of the US Treasury looks generous compared to Japan’s 0.30%, Germany’s 0.45%, France’s 0.62%, the 1.41% of Canada and Spain, as well as Italy’s 1.56%. Expectations of a further appreciation by the dollar exchange rate would enhance the relative attractiveness of US Treasury bonds. (Figure 2.)

Spread Widening Includes Industries Likely to Benefit from Cheaper Energy

However, worry over how the stronger dollar and the current worldwide underutilization of productive resources might put unwanted downward pressure on US product prices has widened the yield spreads of US corporate bonds, notwithstanding expectations of a climb by US real GDP growth from 2014’s prospective 2.4% to 2015’s projected 3.2%. The spread widening of the past 12 months has been most pronounced for those industries suffering direct hits from price deflation. For example, the 161 bp widening by Credit Suisse’s US high yield bond spread of the last 12 months has been dominated by the swellings of 464 bp for high yield energy companies and the 327 bp for the metals/minerals group.

Nevertheless, even the high yield bond spreads of industries that are likely to benefit from sharply lower energy prices have widened over the past year. In terms of the broadening of spreads since late January 2014, these industries include the 56 bp of airlines, the 77 bp of autos, the 113 bp of residential real estate development, the 140 bp of building materials, and the 146 bp of retailing. Apparently, markets fret over a possible fanning out of softer prices that might adversely affect systemic liquidity, in general.

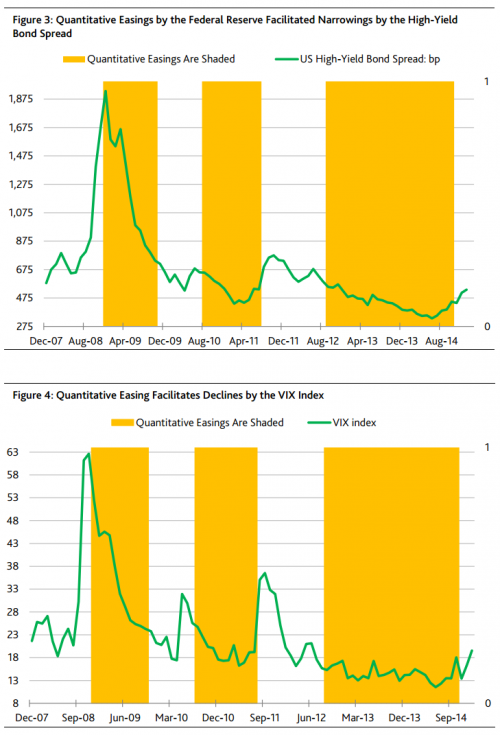

ECB’s QE May Narrow Spreads and Lower the VIX Index

However, if quantitative easing by the ECB succeeds at steadying the outlook for Eurozone price inflation, high yield bond spreads might benefit globally. In response to the Federal Reserve’s recent application of QE3, the US high yield bond spread’s month-long average narrowed from June 2012’s 679 bp to the current upturn’s 331 bp bottom of June 2014. Following October 2014’s expiry of QE3, the high-yield bond spread subsequently widened to a recent 536 bp. Yet, the surge by US equity prices in immediate response to the ECB’s policy move portends a renewed narrowing by the US high-yield bond spread.

How US corporate bond spreads fare during the ECB’s ongoing application of QE may influence the timing of the Fed’s next rate hike. For example, the last two starts to extended series of Fed rate hikes (February 1994 and June 2004) occurred in the context of high-yield spreads of less than 400 bp. Thus, a hiking of fed funds is more likely if quantitative easing by the ECB helps to narrow the US’ high-yield bond spread. (Figure 3.)

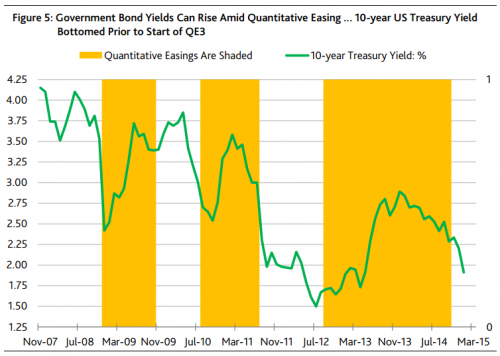

Quantitative easings by the Federal Reserve did more than abet narrowings by the high yield bond spread, they also helped to lower the VIX index. Thus, at a minimum, the amplification of ECB monetary stimulus implies that European share prices are likely to be higher than otherwise. (Figure 4)

ECB’s Move Offers No Assurance of Lower Yields for the Core Economies

Thus far, the anticipation of the ECB’s bond buying program has done more to lower the government bond yields of the Eurozone’s peripheral economies than to the yields of the group’s core economies. For example, in terms of 10-year government bond yields, Germany’s recent 0.45% was up slightly from its record low, the yields of 1.41% for Spain and 1.56% for Italy were new record lows. In turn, the government bond yield spreads of Spain and Italy are now the thinnest vis-a-vis German bond yields since the Eurozone crisis emerged in 2010.

Though quantitative easing tends to narrow the bond yield spreads of riskier borrowers, it does not assure lower bond yields for the “risk-free” benchmarks. For example, the 10-year US Treasury yield’s month-long average bottomed before the unveiling of QE3 in July 2012 at 1.50% and would average 1.81% during the first six months of the Fed’s latest episode of bond purchases. If the market believes in the efficacy of the ECB’s quantitative easing, the 10-year German government bond yield may have already set its low for the current cycle. If that proves true, US Treasury yields are all the more likely to rise. (Figure 5.)

John Lonski , January 2015

Focus

Strategy CPR AM has recently launched CPR Invest – Global Disruptive Opportunities | A look back at an accelerating phenomenon: disruption

The recently theorised phenomenon of "disruption" is defined as a process whereby a product, a service or a solution disrupts the rules on an already established market. Technological progress, along with the globalisation of trade and demographic changes are now helping to (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |