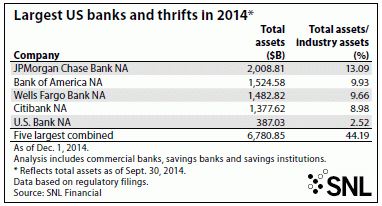

5 banks hold more than 44% of US industry’s assets

Five companies owned more than 44% of the U.S. banking industry’s total assets at Sept. 30 — a dramatic increase from decades past according to SNL Financial’s latest report released today.

For the purposes of this analysis, SNL defined the banking industry as commercial banks, savings banks and savings institutions. JPMorgan Chase Bank NA, Bank of America NA, Wells Fargo Bank NA, Citibank NA and U.S. Bank NA together held $6.781 trillion in total assets at the end of the third quarter, compared to the $8.565 trillion held by the entire rest of the banking industry. JPMorgan Case Bank NA, the main commercial bank subsidiary of JPMorgan Chase & Co., owned more than 13% of the entire industry’s assets.

The concentration of assets among the banking industry’s biggest players has climbed steadily since the 1990s, although the pace of that growth has slowed slightly in recent years. In 1990, for example, the five largest U.S. banks had just $457.92 billion in assets, or 9.68% of the industry’s total assets. Only once — from 1999 to 2000 — did the top five banks’ share of the industry’s assets shrink year over year.

Next Finance , December 2014

See online : SNL Financial Report: 5 Banks Hold More Than 44% of US Industry Assets

Focus

News Institutional investor appetite is back for quant funds

The recent CTA performances encourage institutional investors to more closely monitor this type of hedge fund. Thus, according to Preqin, 52% of them wish to increase their exposure to this type of alternative strategy this year (vs 14% last (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |