Follow The Flow: Vol under control = strong inflows into IG getting even stronger

According to Bank of America Merrill Lynch, with rates vol remaining at low levels, and rates uncertainty contained, investors reached for yield. Credit spreads will keep squeezing tighter, as long as these inflows continue.

Article also available in :

English ![]() |

français

|

français ![]()

Largest inflow into mid and long-term IG funds

With rates vol remaining at low levels, and rates uncertainty contained, investors reached for yield. Inflows into IG mid- and long-term funds hit a record. Inflows into equities remained strong; the same for EM debt. As for HY, we note that last week’s outflow was heavily overstated, as it was primarily driven by only one fund.

Over the past week…

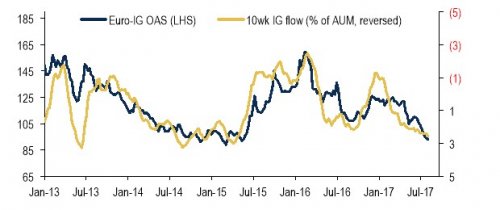

High grade funds recorded another weekly inflow; their 28th in a row. The latest inflow was the highest in eight weeks. The stronger the inflow, the stronger the spread-tightening in the market (chart 1). High yield fund flows remained negative for a sixth week in a row. Looking into the domicile breakdown for last week, the aggregate number has been pulled down mainly by European-focused funds, under the impact of one fund’s heavy outflow. US-focused and globally-focused funds also suffered outflows, but to a smaller extent.

Government bond fund flows were positive for the second week. Overall, Fixed Income funds recorded their 20th consecutive weekly inflow; the largest in eight weeks.

European equity fund flows recorded another inflow; the fourth in a row. The asset class has already recorded over $30bn of inflows year to date, in a big shift from last year’s trend, where the asset class had close to $100bn of outflows.

Chart 1: Cumulative weekly flows into IG (% of AUM) vs spreads

Global EM debt funds continued to record inflows for the 27th consecutive week and the largest in six weeks. Commodities funds recorded their second inflow in a row, albeit a marginal one.

On the duration front, inflows were sizable - the largest ever — in the mid-term part of the curve. Short-term IG funds recorded their 33rd positive flow; however, the pace of inflows has weakened further to the lowest in six weeks. Flows into mid-term funds remained positive for the 19th consecutive week. Flows into long-term IG funds turned positive for the first time in four weeks. Last week’s inflow into the back-end was the largest in 18 weeks.

Next Finance , August 2017

Article also available in :

English ![]() |

français

|

français ![]()

Focus

News Institutional investor appetite is back for quant funds

The recent CTA performances encourage institutional investors to more closely monitor this type of hedge fund. Thus, according to Preqin, 52% of them wish to increase their exposure to this type of alternative strategy this year (vs 14% last (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |