| https://www.next-finance.net/en | |

|

Opinion

|

Total Return Futures set for further growth as buy-side adoption increases

Eurex launched Total Return Futures (TRFs) in 2016 in response to growing demand for listed alternatives to total return swaps. Since then, the product has evolved into an instrument used by a wide variety of firms for multiple purposes, enabling firms to lock in financing rates and as a beta replacement tool.

Article also available in :

English ![]() |

français

|

français ![]()

TRFs gained further traction from the introduction of the Uncleared Margin Rules (UMR), which has driven firms across the buy and sell side to reduce OTC exposures. In addition to reducing capital costs, TRFs enable portfolio margining with other equity and equity index products traded at Eurex and offer risk mitigation for issuers of structured products, allowing the hedging of delta, dividend and repo exposures on the major underlying European benchmarks.

These benefits have enabled TRFs to make significant inroads into the overall market for total return products.

“TRFs have been one of the most successful product launches at Eurex. Volume and open interest have grown exponentially since their launch in 2016,” says Antoine Deix, Head of Dividends & Repo Solutions at BNP Paribas.

That growth has been driven by the listed market’s economic and counterparty risk benefits, with growing demand for listed products accelerating in the wake of UMR. The second growth driver has been the entry into the market of investors that have historically not engaged with OTC markets.

“TRFs have engaged a much larger audience than the OTC products were able to reach,” says Deix. “The game changer has been the net margin benefits. This drove a large swathe of firms to switch to listed products. But the entry of new participants into the market has brought more diversity and depth to the product.”

Use cases

TRFs are synthetic cash instruments allowing an investor to get exposure to the total returns of an underlying index until expiry while at the same time paying the financing costs to the counterparty for providing those returns.

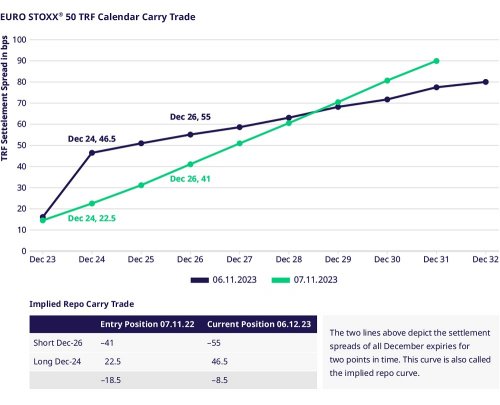

There are two core use cases for investors to trade TRFs. The first is the calendar carry trade , where an investor takes a position on the difference between two points on the forward financing curve. The second is to go long or short on an index and use the product as a simple beta replacement trade.

TRF maturities go out to 10 years and investors can trade the spread across the curve, for example, selling longer-dated and buying shorter-dated to take a financing spread.

The TRFs enable investors to extract the expected carry from the repo parameters without exposure to dividend risk. In addition, it also mitigates the associated quarterly expiry roll.

“It is the best of both worlds between the OTC total return swap and the listed price return future,” says Deix.

“For Beta replacement, you can trade longer maturities than front price return futures, thus reducing the rolling risk, removing dividend risk while locking in your financing spread.”

“For Alpha strategies, total return futures are the best way to access the repo parameters without having exposure to dividends or rates,” says Deix.

Nicholas von Kageneck, senior vice president equity and index sales at Eurex, adds: “TRFs enable investors to reduce the dividend risk and minimize the risk of the roll period. In 2020, when there was significant dividend uncertainty, asset managers preferred to trade total return futures rather than the classical future to minimize dividend risk.”

Future growth

Opportunities to trade the calendar spread are market-dependent. Movements in rates over the past twelve months have resulted in higher short-term financing costs and a flatter curve, making the carry trade less attractive than it had been since the launch of TRFs.

However, Deix says there are still investors doing the carry trade, and he expects more players to enter the market once the curve starts to steepen.

At the same time, he says he sees more interest from investors running systematic strategies on TRFs.

“The growth of systematic strategies adopting TRFs is a trend I expect to continue,” he says.

“In addition, if we see more asset managers adopting one-year positions in the TRF rather than three-months in the price return futures to lower the quarterly roll and dividend risk, this could be another driver of growth prospect to this market.”

The EURO STOXX 50® is the most traded of the TRFs as a strong structured products market is associated with the index. There are also several smaller indices that attract investment because of structured product flow. The suite is currently expanding as investors increasingly adopt exposures.

As the suite of products expands and awareness among the buy side grows, adoption and use cases will continue to increase.

“Although we know the bulk of the trades are performed in the block market, we believe there is a possibility to grow business in the order book to make the product more attractive and visible to the buy side,” says von Kageneck. “For them, it is important to see tradable levels in the order book provided by market makers, helping them to make their investment decisions.”

Next Finance , November 2023

Article also available in :

English ![]() |

français

|

français ![]()

Focus

Opinion Psychology and smart beta

‘Smart beta’ sounds like an oxymoron. How smart can it be to continue using the same strategy in such fickle markets? A portfolio manager calling on all his skills (‘alpha’) in analysing market environments (the source of ‘beta’) should be able to outperform an unchanged (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |