ETFGI reports the Global ETFs industry gathered net inflows of US$64.64 billion during August

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today the global ETFs industry gathered US$64.64 billion in net inflows in August 2023, bringing year to date net inflows to US$529 Bn...

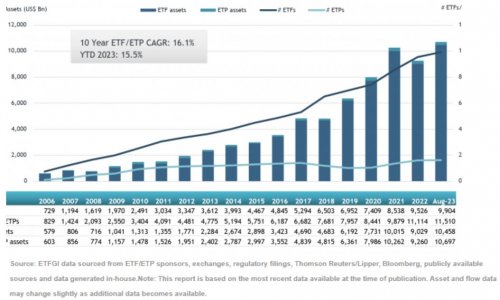

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today the global ETFs industry gathered US$64.64 billion in net inflows in August 2023, bringing year to date net inflows to US$529 Bn. Year-to-date assets have increased 15.5%, going from $9.26 trillion at end of 2022 to $10.70 trillion, according to ETFGI’s August 2023 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service.

“The S&P 500 decreased by 1.59% in August but is up by 18.73% YTD in 2023. Developed markets excluding the US decreased by 3.92% in August but are up 10.58% YTD in 2023. Netherlands (down 9.59%) and Hong Kong (down 9.13%) saw the largest decreases amongst the developed markets in August. Emerging markets decreased by 5.08% during August but are up 5.44% YTD in 2023. Colombia (down 12.70%) and Pakistan (down 11.09%) saw the largest decreases amongst emerging markets in August.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETFs industry asset growth as of the end of August

At the end of August, the Global ETFs industry had 11,510 products, with 23,497 listings, assets of US$10.70 trillion, from 713 providers listed on 81 exchanges in 63 countries.

During August, ETFs gathered net inflows of $64.64 Bn. Equity ETFs reported net inflows of $37.22 Bn over August, bringing YTD net inflows to $250.15 Bn, significantly lower than the $314.99 Bn in net inflows YTD in 2022. Fixed income ETFs gathered net inflows of $16.73 Bn during August, bringing YTD net inflows to $184.41 Bn, higher than the $137.44 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $2.84 Bn during August, bringing YTD net outflows to $6.37 Bn, significantly lower than the $1.63 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $13.83 Bn during the month, bringing YTD net inflows to $98.53 Bn, higher than the $80.70 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $33.09 Bn during August Huatai-Pinebridge CSI 300 ETF (510300 CH) gathered $4.87 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows August 2023: Global

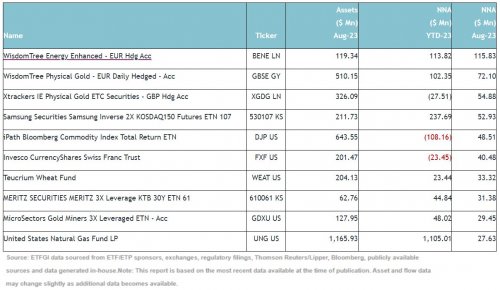

The top 10 ETPs by net new assets collectively gathered $506.51 Mn over August. WisdomTree Energy Enhanced - EUR Hdg Acc (BENE LN) gathered $115.83 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows August 2023: Global

Investors have tended to invest in Equity ETFs/ETPs during August.

Investors have tended to invest in Equity ETFs/ETPs during August.

Next Finance , September 2023

Focus

News Institutional investor appetite is back for quant funds

The recent CTA performances encourage institutional investors to more closely monitor this type of hedge fund. Thus, according to Preqin, 52% of them wish to increase their exposure to this type of alternative strategy this year (vs 14% last (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |