| https://www.next-finance.net/en | |

|

Strategy

|

Are investors too confident?

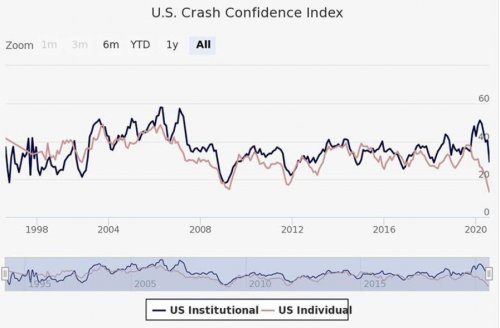

With stock markets close to all-time highs at a time of very elevated economic uncertainty, the question arises if investors have become too confident. Today’s chart from The Yale School of Management Stock Market Confidence Indexes reveals how probable U.S. individual and institutional investors think a stock market crash is.

Article also available in :

English ![]() |

français

|

français ![]()

With stock markets close to all-time highs at a time of very elevated economic uncertainty, the question arises if investors have become too confident. Today’s chart from The Yale School of Management Stock Market Confidence Indexes reveals how probable U.S. individual and institutional investors think a stock market crash is.

The exact question asked to calculate the U.S. Crash Confidence Index is the following: What is the probability of a catastrophic stock market crash occurring in the next six months in the U.S. on a scale comparable to October 28, 1929 or October 19, 1987 (including if a crash occurred in other countries and spread to the U. S.)?

As depicted in the graph, individual investors think there is only a 13% chance of this happening. This is the lowest probability recorded since the index was founded in October 1989. Institutional investors are slightly less optimistic, with a probability of 29% – which is more in line with the long-term average. Based on the Yale School of Management U.S. Crash Confidence Index, it seems pretty clear that individual investors are too optimistic.

The second Covid-19 outbreak jeopardizes economic recovery, especially as governments around the world have reinstated partial lockdowns. If this coincides with a strong turn in market sentiment, for example because investors start to question the effectiveness and/or scope of extraordinary fiscal and monetary policy, another big market crash remains a possibility. Or, at the very least, the probability of this is happening is higher than 13%.

Jeroen Blokland , October 2020

Article also available in :

English ![]() |

français

|

français ![]()

Focus

Strategy CPR AM has recently launched CPR Invest – Global Disruptive Opportunities | A look back at an accelerating phenomenon: disruption

The recently theorised phenomenon of "disruption" is defined as a process whereby a product, a service or a solution disrupts the rules on an already established market. Technological progress, along with the globalisation of trade and demographic changes are now helping to (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |