| https://www.next-finance.net/en | |

|

Opinion

|

Beware the dangerous emerging market ‘grand narrative’

The emerging markets (EM) ‘grand narrative’ that you hear constantly churned out is at best misleading and at worst dangerous...

The story goes something like this. You should have a large allocation to EM debt because (1) EM countries have much higher GDP growth rates than developed countries, (2) EM countries have much lower public debt levels than developed countries, (3) EM countries have far superior demographics, (4) EM debt yields more than developed country debt, and (5) EM debt is an ‘under-owned’ asset class in investors’ portfolios.

In the following, we show that the performance of EM debt has not been driven by the ‘EM grand narrative’ of stronger GDP growth, superior demographics and low public debt/GDP levels. It is instead driven primarily by global risk appetite, US Treasury yields, and in the case of external debt, the US dollar. EM local currency sovereign debt has a very close correlation to equities. Holders of EM external debt would have been provided with a near identical return had they instead invested in US corporate bonds, which is intuitive if you consider that (a) US corporate bonds and EM external debt share the same currency; (b) are both benchmarked off US Treasuries; and (c) the credit risk premia on EM external sovereign debt, EM corporate debt and US corporate debt are correlated both to each other and to risk assets such as equities.

What drives em debt performance?

While correlations can change, the evidence of the past half decade suggests that EM debt remains wedded to the ongoing global financial crisis. Local currency debt is particularly exposed to Europe; indeed, Poland, Turkey, Russia and Hungary together form over 35% of the commonly used JPM GBI-EM Global Diversified Composite Index, and the Hungarian Forint (HUF) and Polish Zloty (PLN) tend to behave as a high beta exposure to the euro.

The risk characteristics of the three EM debt subsets – EM local currency sovereign debt, EM external sovereign debt and EM corporate debt – can be seen in the charts below and overleaf. EM local currency sovereign debt has exhibited a very close correlation to risk assets such as equities, as represented by the DAX, Germany’s main equity index, and therefore has had little benefit as a diversifier within a portfolio of other risky assets since the financial crisis began.

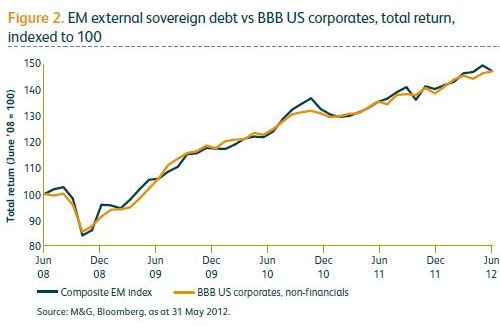

Meanwhile, EM external sovereign debt has a very close correlation to US corporate bonds. The first chart overleaf (figure 2), shows the exceptionally close relationship between EM external sovereign debt, as represented by a composite index of BBB and BB emerging market sovereigns, and US BBB non-financial corporates.

The composite EM index is composed of the Merrill Lynch USD BBB Rated Emerging Markets Sovereigns Index and the Merrill Lynch USD BB Rated Emerging Markets Sovereigns Index at equal weights. This was to roughly approximate the credit risks of the two asset classes.

EM corporate bonds unsurprisingly also have a very close correlation to US corporate bonds, as illustrated by the third chart (figure 3). It shows the return profile between EM corporate debt and a US dollar BB non-financial corporate index (note that there is a small degree of crossover of the two indices).

What this means for em debt

We have discussed EM debt’s vulnerability to Europe before, and these concerns have since worsened. As discussed overleaf, emerging market debt performance is largely a function of global risk appetite, US Treasuries and the US dollar. My view continues to be that political paralysis makes a lasting solution to the eurozone debt crisis unlikely, and it is more likely than not that one or more countries will either be forced to exit the eurozone or may willingly leave.

While EM debt performance is likely to be dictated by Europe over the short to medium term, we are increasingly concerned about domestic problems building in a number of emerging markets, primarily in China. If Asian growth slows dramatically then the winner in global financial markets will likely be the US dollar. A strengthening of the US dollar could have very destabilising effects for local currency EM debt, given that a large percentage of portfolio flows that have gone into the asset class in the last decade have come from US investors desperate to diversify their FX exposure away from a depreciating US dollar. A reversal of the huge capital inflows into EM debt would result in a total lack of liquidity and significantly higher borrowing costs for emerging market countries. It won’t be just the EM sovereigns that have come to rely on these capital flows and the cheap financing this entails; EM banks and to a lesser extent EM corporates are probably in a similar position.

Our current strategy in the M&G Emerging Markets Bond Fund is therefore to be defensively positioned, and we favour external debt over local currency debt. We have only a negligible exposure to Eastern European debt, and more than half of the fund is invested in the US dollar.

The M&G Global Macro Bond Fund, our fully flexible global bond fund, also reflects our bearish view on emerging markets. We have outright negative positions in Brazil, Poland, Russia and Turkey where we have the strongest conviction views that credit spreads do not sufficiently reflect the risks associated with these countries. In addition, the M&G Optimal Income Fund has short positions in Brazil and Turkey. In terms of currency exposures, the M&G Global Macro Bond Fund has over a 50% weighting in the US dollar and a zero weighting in emerging market currencies at present, while the M&G Optimal Income Fund has some exposure to the US dollar.

Mike Riddell , August 2012

Focus

Opinion Psychology and smart beta

‘Smart beta’ sounds like an oxymoron. How smart can it be to continue using the same strategy in such fickle markets? A portfolio manager calling on all his skills (‘alpha’) in analysing market environments (the source of ‘beta’) should be able to outperform an unchanged (...)

RSS Feeds

| News Feed | |

| Jobs & Internships | |

| Trainings |

Site | English | Francais | Mobile | Facebook | Twitter |